The world of financial markets is a complex tapestry woven with the threads of numbers, trends, and predictions. Among the tools that investors, analysts, and market enthusiasts employ, rose charts have emerged not only as an analytical tool but also as an aesthetically pleasing depiction of market dynamics. In this comprehensive guide, we unravel the enchanting dynamics of rose charts, examining how they contribute to robust market analyses and their unique charm.

At their core, rose charts, also known as polarized market indicator or PMIs, are a method of representing market data in a visually appealing, circular format that mimics the look of a rose diagram. This visual approach allows for an intuitive understanding of market shifts and patterns that might not be as evident in traditional linear graphs.

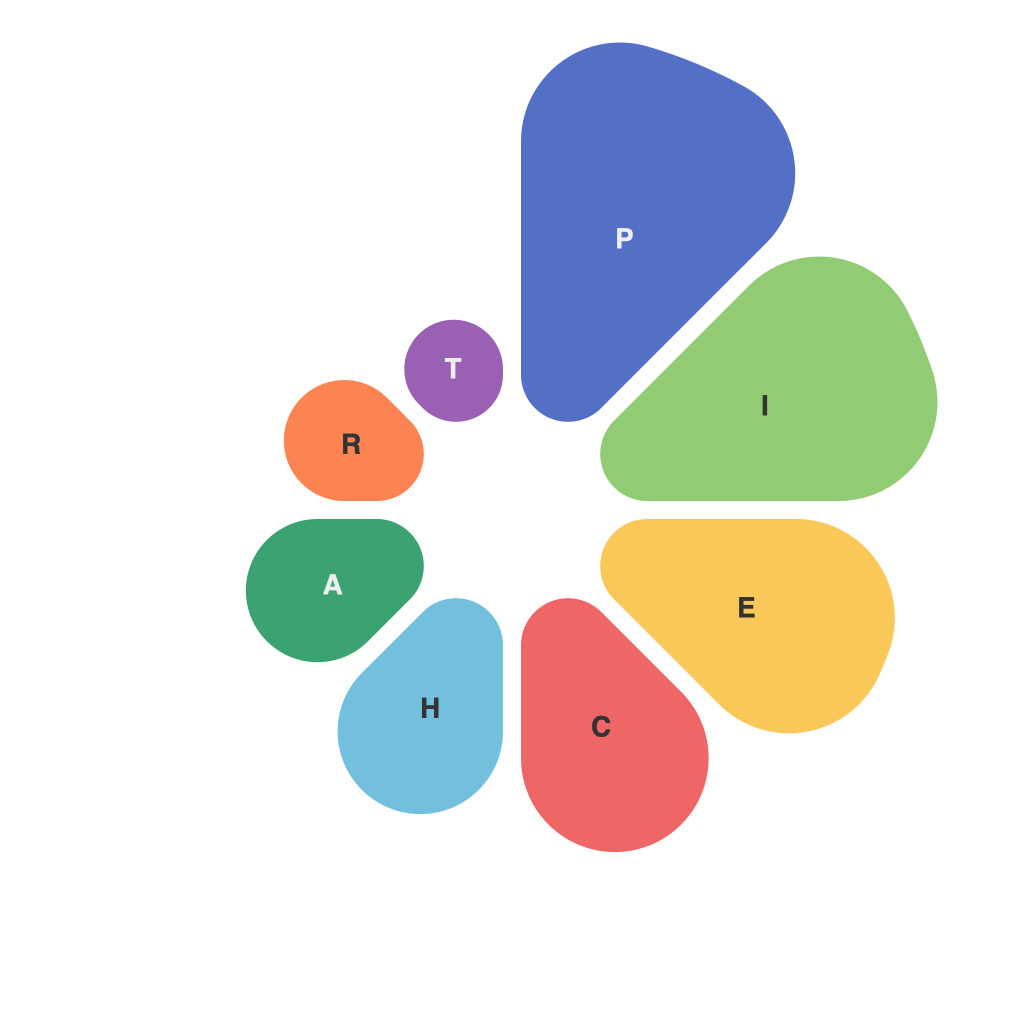

The Anatomy of a Rose Chart

A typical rose chart is broken down into multiple wedges, each representing a unique dataset or indicator. The chart’s structure is reminiscent of a rose flower, with each petal corresponding to a statistical measure. These measures often include price movement, volume, volatility, and liquidity, making the rose chart a versatile tool for assessing multiple aspects of market health.

The petals can either be segmented by the frequency of price movement or other time-based increments, offering insights into market activity over different time scales. By organizing data in this manner, rose charts enable analysts to identify underlying trends that may elude them in more conventional chart forms.

Reading the Rose: An Illustration

Imagine an investor looking at the current dynamics of the stock market’s trendiness. A rose chart for this purpose might have the following segments:

1. **Breadth Index:** Reflects the overall market conditions by comparing stocks’ price changes to the index.

2. **Volume:** Slices of the chart indicate the volume of transactions, highlighting periods of significant market activity.

3. **New Highs and Lows:** This segment indicates the number of stocks reaching new highs or lows within a given period, vital for gauging market sentiment and optimism.

The combination of these indicators provides an at-a-glance picture of the undercurrents moving beneath the surface of the market’s surface prices.

The Power of Polarization

One of the most intriguing aspects of rose charts is their polarization. The chart takes the data, converts it into a polar angle, then maps this angle to a circle. This polar transformation allows for the portrayal of a 360-degree view of the market, giving analysts the ability to identify relationships between different variables that might not be apparent in traditional 2D representations.

For instance, a strong segment near 180 degrees might suggest a high correlation between the movement of the market and a particular factor—like volume increasing as prices fall, indicating bearish sentiment.

Analytical Insights and Predictive Value

The aesthetic quality of rose charts is more than just eye-catching; they provide valuable analytical insights. The use of colors, sizes, and shapes adds another layer to the data visualization process. For example, a larger segment may represent a more significant piece of the market or a strong driver of market behavior.

Moreover, the predictive value of rose charts is undeniable. As they offer an alternative perspective to the traditional candlestick or bar charts, analysts can use rose charts to identify patterns that could predict future market movements with greater accuracy.

Conclusion: The Art of Analysis

In conclusion, rose charts are a testament to the marriage between art and analytics in the field of financial market analysis. They harness the power of geometry and color to offer a unique lens through which to view and understand market dynamics.

Through their intricate structure and ability to capture a wide range of data points in one consolidated visualization, rose charts stand out as an invaluable tool for both seasoned investors and newcomers to the market. Their enchanting visual appeal paired with their analytical depth make them an indispensable asset in the financial analyst’s toolkit.

As with any analytical tool, proficiency with rose charts comes with practice and expertise. But once mastered, they open new vistas into the fascinating world of markets and their endless patterns. The rose chart may not flower as brightly as the rose in the garden, but in the landscape of financial analysis, its beauty is clear and its wisdom profound.